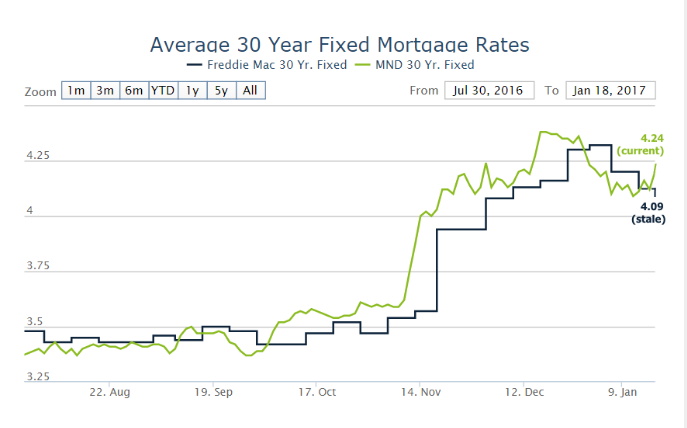

At the beginning of 2017, there was good news in regards to mortgage rates. After 9 consecutive weeks of rising mortgage rates, the rate finally fell. However, at 4.2%, the rate is still higher than economists would like to see.

Sean Becketti, chief economist with Freddie Mac, said that this was the first time since 2014 that mortgage rates opened the year above 4% (Source).

The current rate is somewhere between 4.125% and 4.25%, reports mortgagenewsdaily.com. The mortgage website goes on to explain that rates have risen .125% this week. Although .125% doesn’t seem like a big number, the biggest issue is the closing costs for borrowers wishing to lock in the lower rates from earlier in the week. ” On average, you’d need to pay an extra $650-750 (per $100k financed) upfront to lower your rate by .125%. In that sense, if you opted not to lock a $300k loan on Wednesday, the past 2 days cost $1950-$2250,” writes Matthew Graham with mortgagenewsdaily.com.

Here’s a look at the mortgage rates from July 30, 2016 through mid-January 2017.

Here’s a look at local mortgage rates:

| Bank | Rate |

| Pinnacle National Bank | 4.147% |

| Community First Bank | 4.153% |

| Regions Bank | 4.277% |

| Fifth Third | 4.275% |

| Citizens Bank | 4.278% |

* The above mortgage loan information is provided to, or obtained by, Bankrate. The rate is based on 30 year fixed rate mortgage and a loan of $300,000.

[scroller style=”sc1″ title=”Local Real Estate” title_size=”17″ display=”cats” cats=”16″ number_of_posts=”12″ auto_play=”5000″ speed=”300″]

Please join our FREE Newsletter