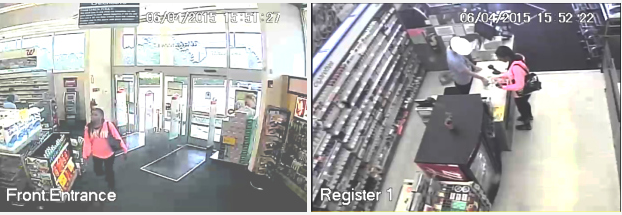

Franklin Police want to identify this woman, who used a cloned credit card to purchase reloadable gift cards. It happened last Friday at the Walgreens on Fieldstone Pkwy near Hillsboro Rd. The total loss in this case is $255.00.

Information about this suspect is worth up to $1,000 with one simple, anonymous call to Crime Stoppers: (615) 794-4000.

According to the Tennessee Bureau of Investigation, 9,381 counts of credit card fraud were reported in 2014 in the state of Tennessee. The City of Franklin had 62 reported cases of credit card fraud in 2014.

5 Ways You May Fall Victim to Credit Card Fraud

Unfortunately, credit and debit card fraud are big issues these days. Bankrate.com provides a helpful list of 5 ways we my unknowingly become a victim of credit card fraud.

1. Failing to look for skimmers--Thieves may attach skimming devices to the exterior of an ATM or point-of-sale terminals requiring a PIN, or personal identification number. It’s worth the few seconds it takes to glance before you swipe.

2 . Banking online at a cafe–You may have free Wi-Fi access at your favorite coffee shop, but you might not want to use it to check the balance in your savings account. If you’re using an open wireless network, it’s easier for hackers to intercept online transactions, passwords and other private business.

3. Responding to phishing messages–If you receive a text message on your phone from your bank, and it asks you to log into your card account immediately — but you didn’t contact the bank — raise your mental drawbridge. The same goes for a message that arrives via Facebook, Twitter or any other mode of communication.

4. Ignoring your rights and responsibilities--If you’ve lost your credit or debit card, suspect it was stolen or think someone has lifted your number off the Internet, call your card issuer immediately. Credit cards offer the greatest protection against fraud. Most card issuers provide zero-liability fraud protection, and federal law says once you report the loss or theft, you have no further responsibility for unauthorized charges. Your maximum liability under federal law is $50 per card.

5. Not using free fraud protection–Additional fraud protection is available for free by numerous card issuers and financial institutions, though most require a little investigation or enrollment. For example, the Verified by Visa program sets up Visa cardholders with an additional password they can use to shop at participating online merchants. MasterCard SecureCode works similarly. It requires the user to enter the correct PIN during checkout at a participating online retailer.

Read more about credit card fraud from Bankrate.com here.

More Franklin Police Updates