Existing home sales and home prices both increased in January, the latter again driven by a tight supply of available houses in many markets. The National Association of Realtors® said home sales were are the fastest pace in six months and prices increased more rapidly than at any time since the last spring market.

Sales of existing single-family homes, townhouses, condominiums, and cooperative apartments were at a seasonally adjusted annual rate of 5.47 million in January. This was an increase of 0.4 percent from a downwardly revised pace of 5.45 million (from 5.46 million) in December. Transactions were up in all regions except the West. Sales were 11.0 percent higher than in January 2015, the largest monthly gain since the 16.3 percent increase posted in July 2013.

Analysts polled by Econoday and reported by Bloomberg had predicted that sales would be in a range of 5.130 to 5.555 million. The consensus was 5.320 million.

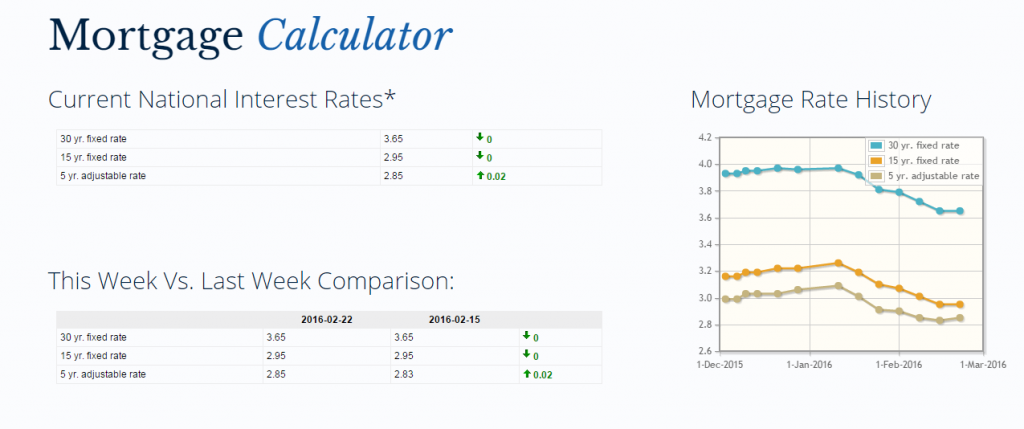

First Community Mortgage of Franklin reports that the current rate for a 30 year fixed mortgage is down .07% from last week.

Some of the latest, local mortgage rates according to Bankrate.com are:

| Bank | Rate |

| Regions | 3.776% |

| Wilson Bank & Trust | 3.895% |

| Pinnacle National Bank | 3.772% |

| Citizens Bank | 3.90% |

| First South | 3.768% |

* The above mortgage loan information is provided to, or obtained by, Bankrate. The rate is based on 30 year fixed rate mortgage and a loan of $300,000. Rates change often an your personal rate may differ from the above number based on your qualifications. To see more rates from Bankrate, click here.

[scroller style=”sc1″ title=”Local Real Estate” title_size=”17″ display=”cats” cats=”16″ number_of_posts=”12″ auto_play=”5000″ speed=”300″]