Mortgage Rates moved higher this week ending a trend of improvement that began after the mid-March FOMC Announcement. The losses weren’t severe, and most lenders are still quoting the same contract rates seen at the end of last week, just with slightly higher upfront costs.

While the bond markets that drive mortgage rates are traditionally interested in economic data, that wasn’t so much the case this week. Several important reports suggested economic weakness and they were generally overlooked by bonds.

Given that rates haven’t moved up much from recent lows and that the previous trend has been broken, locking is a safer strategy at the moment. The average lender is quoting 3.625% on top tier 30yr-fixed scenarios.

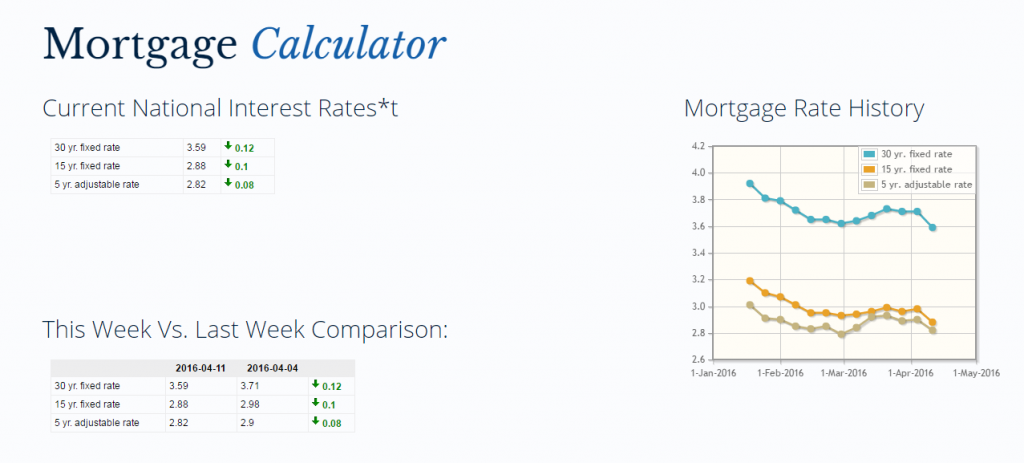

Get a look at national mortgage interest rates and a week-by-week comparison from First Community Mortgage of Franklin:

Some of the latest, local mortgage rates according to Bankrate.com are:

| Bank | Rate |

| Regions | 3.901% |

| Wilson Bank & Trust | 3.770% |

| Cadence | 3.784% |

| Citizens Bank | 3.775% |

| First South | 3.768% |

* The above mortgage loan information is provided to, or obtained by, Bankrate. The rate is based on 30 year fixed rate mortgage and a loan of $300,000. Rates change often an your personal rate may differ from the above number based on your qualifications. To see more rates from Bankrate, click here.

[scroller style=”sc1″ title=”Local Real Estate” title_size=”17″ display=”cats” cats=”16″ number_of_posts=”12″ auto_play=”5000″ speed=”300″]